Restaurant accounting is crucial for the profitable operation of a food services organisation. Effective accounting procedures are essential to ensure the steadiness and durability of a restaurant’s assets, from tracking cash flow to managing expenditures and profits.

Imagine managing a prosperous restaurant, where the surrounding environment is filled with the aroma of mouthwatering cuisine, visitors continually walk in, and the ambience vibrates with energy. However, everything functions well behind the scenes owing to the strong foundation that underlies restaurant accounting.

Even the most prominent restaurants have a risk of failing in the absence of precise accounting. Gaining expertise in restaurant accounting is fundamental to your success as a restaurateur, irrespective of your experience level.

We will go over the essentials of restaurant accounting in this extensive guide and the most reliable ways to keep precise accounting records. Firstly, let’s check out why restaurant accounting is important.

The building block of how your business operates is restaurant accounting. It supports you in keeping track of expenses, managing cash flow, and making informed choices that have the power to either build or demolish the success of your restaurant. The following are some key reasons for the importance of restaurant accounting:

Monitoring sales, maintaining cash flow, in addition to making ensuring spending is under budget are all essential components of financial management. Informed decisions on rates, menu revisions, and growth plans may be made by proprietors and managers of restaurants with the help of precise accounting information.

Timely filing of tax returns and timely payment of taxes are made less complicated by reliable records of the payroll, expenditures, and revenues. To minimize the burden of taxes, restaurant accountants might additionally identify relevant tax incentives and deductions.

To establish credibility with investors and creditors, restaurants that are seeking additional funding or investment must maintain reliable accounting records.

Accounting for restaurants encompasses significant tasks, such as keeping records of transactions, limiting spending, reconciling bank accounts, and preparing reports on the finances. The following steps are necessary for managing restaurant accounting effectively:

An experienced bookkeeper helps with continuous financial administration, along with keeping legitimate financial documents. Search for a bookkeeper with experience in the restaurant’s distinct financial necessities and years of expertise in this industry.

To streamline your financial duties, invest in reputable accounting software. The financial statements, managing inventory, payroll, and invoices can all be guided by software. Check out the official site of Canada for additional information regarding accounting and invoicing software for your restaurants.

For thorough financial information, prepare a comprehensive chart of accounts exclusively for the restaurant organization. A restaurant business should be reflected in this chart with separate categories for income, expenditures, assets, and liabilities.

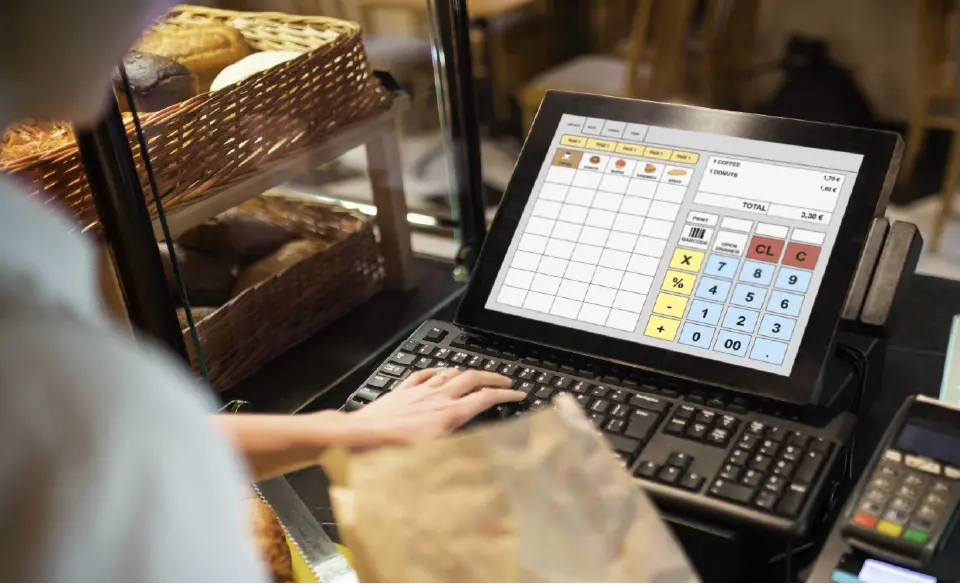

A vital aspect of restaurant accounting is a point-of-sale system. Beyond transaction processing, its functions include managing inventory, sales tracking, and the preparation of informative revenue reports. To ensure seamless data synchronization, use a point-of-sale system that integrates well with your financial management software. Check out more insights related to POS here.

In addition to these measures, you could consider using specialized applications to automate your accounting operations, training your employees in basic accounting concepts, and frequently assessing vendor rates for cost-effectiveness. To maintain legality and financial success, it’s equally essential to stay informed on accounting regulations and industry modification.

Restaurants have exclusive taxation problems that they must cope with, like taxes on payroll, sales taxes, and tip reports. To avoid penalties and fines, it’s significant to maintain adherence to the tax regulations. Ascertain that employees are honestly disclosing their pay by keeping complete records of all transactions, particularly cash tips.

Here are some key tax factors to take into consideration on how Canadian owners of restaurants could decrease their tax liabilities:

Your restaurant, as an employer, is responsible for claiming and submitting income taxes, as well as contributions to the Canada Pension Plan (CPP) and Employment Insurance (EI) on behalf of your staff members.

Appliances, decor, and fixtures that meet specific standards can all be reclaimed by restaurants. One may decrease the taxable earnings and total tax liabilities by correctly recording and filing CCA.

Any gratuity that staff members get is liable for taxation and needs to be disclosed accordingly. Teach your staff members the significance of wisely disclosing their tip money, and make sure the restaurant adheres to all tips-related accounting rules.

Restaurants in Canada must gather and pay GST or HST on goods and services that are taxable. For the sake of accurate reporting, keep detailed records of every transaction and taxes paid.

Effective management of inventory and cost minimization are vital components of a successful restaurant industry. Restaurant owners and directors must take into consideration essential variables to reduce waste and enhance business performance.

To safeguard the nutritional value and quality of ingredients in the restaurant industry, first and foremost, a FIFO (first-in, first-out) inventory management system must be established. The oldest items of stock are used first when using FIFO, protecting items from being left to deteriorate or become expired. This is particularly important in food enterprises since luxurious food relies on a strong foundation of fresh ingredients.

Another essential aspect of restaurant management is cost control. The financial stability of a restaurant may be gained by frequently reviewing the cost of goods sold (COGS) and keeping a watch on the price of meals and beverages compared to the total sales. Restaurant managers can boost revenue by customizing menu offerings, reconsidering vendor deals, or revising portion sizes by strategically identifying areas of unnecessary spending or waste.

The restaurant sector has multiple obstacles concerning payroll management, particularly fluctuating compensation, tips, and overtime. With the advancement of technology, automation is now recognized as an important factor in payroll process optimization, promoting employee happiness and overall operational efficiency.

The rise in satisfaction among workers that arises from automating payroll management is one of its primary benefits. Payroll processing that is precise and completed on time fosters employee morale and reflects the employer’s dedication to fair wages and benefits. Firms may encourage confidence and commitment among their staff members by giving workers a reliable and secure way to get their earnings.

Discover how technological innovation has transformed restaurant payroll.

Accounting for restaurants gets more challenging because of the need to manage the cash flow of multiple sites or franchisees. However, you can improve your accounting processes and obtain additional information about the financial condition of every site if you have the correct systems and practices in place.

An advanced point-of-sale system provides useful information for bookkeeping and financial evaluation along with performing transaction. Accurate recording and seamless transfer of all transaction data to your accounting system are ensured when you integrate your POS system with accounting software. The POS system’s systematic gathering and classifying of sales data allows you to create informative reports that give a clear overview of each location’s outcomes.

You may monitor the financial information for each location independently and classify transactions by allocating classes to various locations within the accounting software. You may gain a broader understanding of the overall financial condition of your firm by using this classification to precisely evaluate profit and loss at the location level.

Get extra information about restaurant bookkeeping for numerous locations.

Your firm’s financial management relies on precise forecasting and budgeting. The following are some essential best practices for forecasting and budgeting in restaurants:

The food and beverage industry is heavily influenced by seasonal trends, which affect everything from menu options to customer traffic.

Accounting blunders in restaurants might end up in costly mistakes and a waste of money. Restaurant owners can ensure the growth and monetary security of their restaurants by implementing best practices into effect and paying careful attention to the financial aspects.

Restaurant proprietors may minimize financial risks while improving the financial stability of their restaurants by keeping accurate records, maintaining personal and business finances distinct from others making an efficient budget, and analyzing accounting records. Restaurant owners can be focused on providing excellent customer service while securing the sustainable future of their firms by setting a high priority on effective accounting processes.

You can ensure your restaurant’s financial longevity by putting forth appropriate accounting practices. You can successfully handle the intricacies of restaurant accounting while preserving the success of the restaurant by being systematic, making the appropriate tool investments, and consulting an expert.

The Accounting Farm has navigated even the most complicated accounting challenges with reliability and skill for 10+ years. For any queries contact us and will be always happy to help you with your queries or any accounting needs.

These items are either zero-rated (0% GST/HST) or exempt from taxation to maintain affordability and accessibility for Canadian citizens.

You can be entitled to a VAT refund on products you bought in Canada if you reside outside Canada and are going to your home country.

Cost accounting offers insightful information on the profitability of each menu item in a restaurant.

Food and beverage items cooked in restaurant kitchens are subjected to value-added tax. Food, drinkware, and other packaged items are excluded from VAT.

Explore the benefits of outsourcing and learn how our team can support your firm with a range of accounting services. From tax preparation and bookkeeping to financial statement audits and advisory services, we provide scalable solutions to meet your evolving needs.

Connect with us even faster by booking a meeting today at a time that works best for you.

Top Accounting Outsourcing Services For CPAs, Accounting, and Bookkeeping Firms.

Hello,

Thanks for visiting our website!

How can we help you?

Start the chat

WhatsApp us